Understandably, share dilution is not often viewed favorably by existing shareholders, and companies sometimes initiate share repurchase programs to help curb the effects of dilution. In situations where a company splits its stock, current investors receive additional shares while the price of the shares is adjusted accordingly, keeping their percentage ownership in the company static. It also becomes more difficult to determine the number of shares outstanding at a given time as more security types are introduced. The concept of dilutive securities can be more theoretical than actual, since these instruments will not be converted into common stock unless the price at which they can be purchased will generate a profit.

Convertible Preferred Stocks

This could indicate that the company is not generating enough profits or that it has a higher potential for dilution. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Anti-Dilutive Securities

- Shares can also be diluted by employees who have been granted stock options.

- Below is a break down of subject weightings in the FMVA® financial analyst program.

- To use it, subtract preferred dividend payments from net income in the numerator and add the number of new common shares that would be issued if converted to the weighted average number of shares outstanding in the denominator.

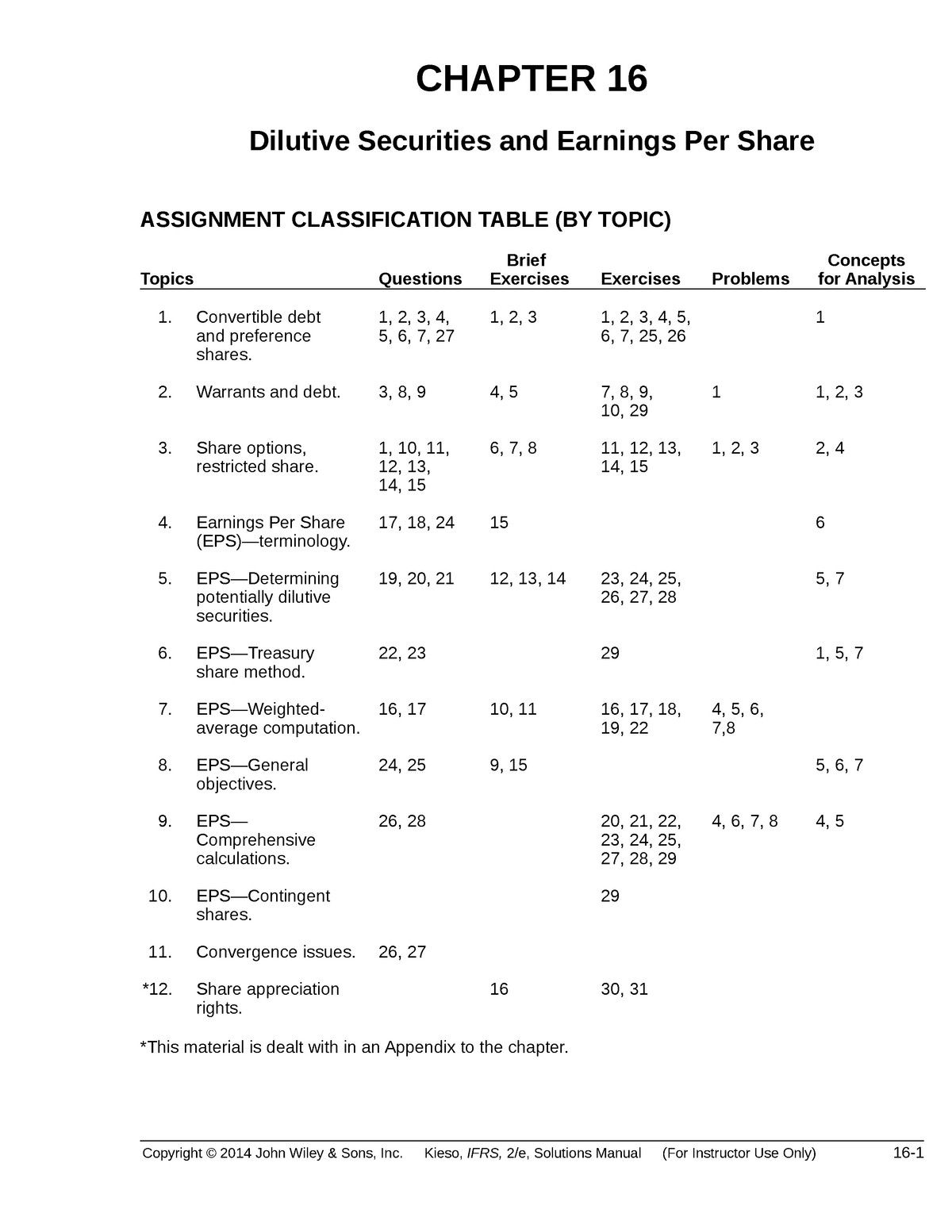

When an ordinary loss occurs in a year, all potential savings from conversions and all potential increases in the number of shares are anti-dilutive. The most widespread application for diluted shares is in calculating the company’s earnings per share (EPS). It is a common metric used by investors to assess the relative value and profitability of a company with its peers. Fully diluted EPS is important for investors, analysts, and companies to assess the impact of various securities on the company’s earnings per share. It is also useful for comparing companies in the same industry and can impact the stock valuation of a company.

Company

That is to say, the worst anti-dilutive unit will be entered into the calculation first. If warrants equivalent to 100,000 common shares are outstanding, including them would change the result to $7,000,000 / 1,500,000, or a loss of only $4.67 per share. When calculating earnings per share (EPS), including the effects of a potentially dilutive security sometimes produces a higher per-share figure. For example, companies in the technology industry may have more stock options and warrants than companies in the manufacturing industry.

Warrants are often issued as a part of a bond offering and can be exercised at a later date. Stock options and similar securities come with a vesting period, usually a few years, before they can be exercised. This may result in employees leaving before the vesting period is over, leading companies to inaccurately estimate the number of options that will be vested. Secondary offerings are commonly used to obtain investment capital to fund large projects and new ventures. There are many scenarios in which a firm could require an equity capital infusion. In a scenario where a firm does not have the capital to service current liabilities and can’t take on more debt due to covenants of existing debt, it may see an equity offering of new shares as necessary.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, online invoicing portal and the opinions are our own. Industry-specific factors can also impact the fully diluted EPS calculation. Investors should be cautious when investing in companies with low fully diluted EPS as they may have a higher risk of poor financial performance.

Share dilution may happen any time a company raises additional equity capital, as newly created shares are issued to new investors. The potential upside of raising capital in this way is that the funds the company receives from selling additional shares can improve the company’s profitability and growth prospects, and by extension the value of its stock. If converted, dilutive securities effectively increase the weighted number of outstanding shares, decreasing EPS, and thereby devaluing a shareholder’s existing equity stake. Weighted average anti-dilution provisions are generally viewed as more company-friendly than full ratchet provisions.

Anti-dilutive securities do not affect shareholder value and are not factored into the diluted EPS calculation. The new share price of the company will be lower than its share price before dilution. The reason for this is that the market capitalization of the company is divided by a greater number of shares. The markets factor this in, and the result is a decrease in the company’s share price.