And that leverage also translates into the volatility of the operating income or operations of the company. During the 1990s, investors marveled at the nature of its software business. The company spent tens of millions of dollars to develop each of its digital delivery and storage software programs. But thanks to the internet, Inktomi’s software could be distributed to customers at almost no cost.

Ask Any Financial Question

At the end of the day, the firm’s profit margin can expand with earnings increasing at a faster rate than sales revenues. If fixed costs are high, a company will find it difficult to manage short-term revenue fluctuation, because expenses are incurred regardless of sales levels. This increases risk and typically creates a lack of flexibility that hurts the bottom line. Companies with high risk and high degrees of operating leverage find it harder to obtain cheap financing. Operating leverage measures a company’s fixed costs as a percentage of its total costs. It is used to evaluate a business’ breakeven point—which is where sales are high enough to pay for all costs, and the profit is zero.

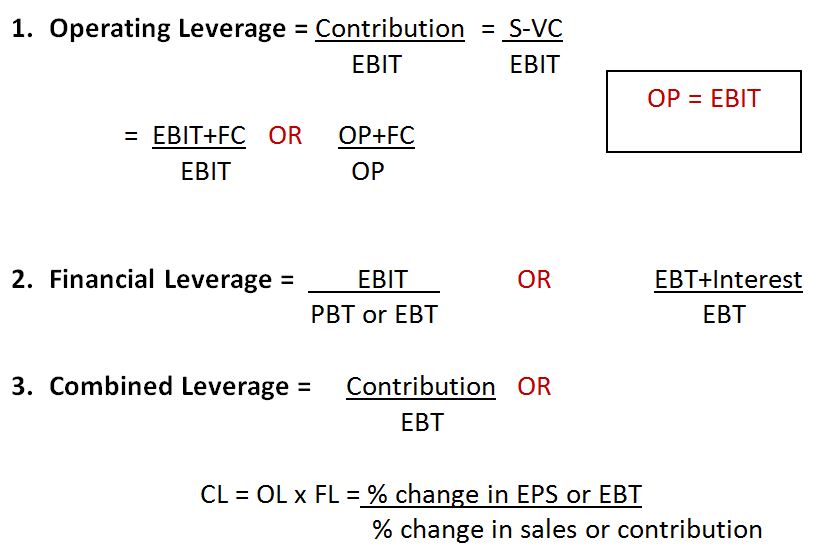

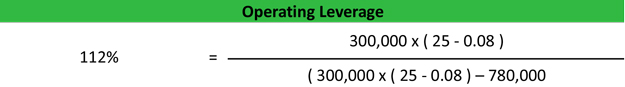

Formula

- This means that they are fixed up to a certain sales volume, varying to higher levels when production and sales volume increase.

- Yes, but ensure you’re comparing companies within the same industry or sector, as operating leverage can vary significantly between different types of businesses.

- Variable costs such as commissions flex as revenues rise, and commission expenses rise in tandem.

- Get instant access to video lessons taught by experienced investment bankers.

- By contrast, a retailer such as Walmart demonstrates relatively low operating leverage.

But companies with a lot of costs tied up in machinery, plants, real estate and distribution networks can’t easily cut expenses to adjust to a change in demand. So, if there is a downturn in the economy, earnings don’t just fall, they can plummet. In contrast, a company with relatively low degrees of operating leverage has mild changes when sales revenue fluctuates. Companies with high degrees of operating leverage experience more significant changes in profit when revenues change. Once obtained, the way to interpret it is by finding out how many times EBIT will be higher or lower as sales will increase or decrease respectively.

Our Services

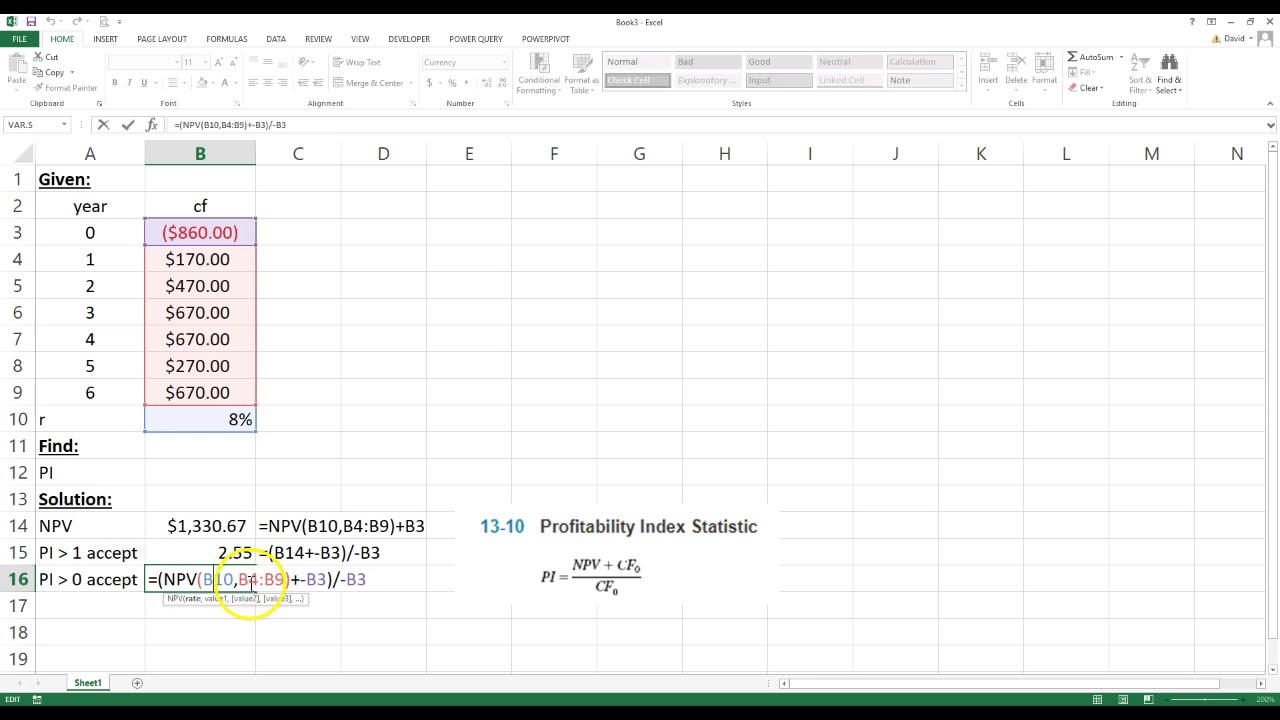

If revenue increased, the benefit to operating margin would be greater, but if it were to decrease, the margins of the company could potentially face significant downward pressure. When a company’s revenue increases, having a high degree of leverage tends to be beneficial to its profit margins and FCFs. If a company has high operating leverage, each additional dollar of revenue can potentially be brought in at higher profits after the break-even point has been exceeded. On that note, the formula is thereby measuring the sensitivity of a company’s operating income based on the change in revenue (“top-line”). As a company generates revenue, operating leverage is among the most influential factors that determine how much of that incremental revenue actually trickles down to operating income (i.e. profit).

Companies with higher operating leverage carry higher fixed costs regardless of whether they do $1 of sales or millions. Low-operating leverage companies may have higher variable, fixed costs but lower fixed costs. A company’s operating leverage translates revenue growth into operating income, or EBIT (earnings before interest and taxes).

A company with high operating leverage has a large proportion of fixed costs—which means that a big increase in sales can lead to outsized changes in profits. A company with low operating leverage has a large proportion of variable costs—which means that it earns a smaller profit on each sale, but does not have to increase sales as much to cover its lower fixed costs. hot sauce of the month club The bulk of this company’s cost structure is fixed and limited to upfront development and marketing costs. Whether it sells one copy or 10 million copies of its latest Windows software, Microsoft’s costs remain basically unchanged. So, once the company has sold enough copies to cover its fixed costs, every additional dollar of sales revenue drops into the bottom line.

One measure that doesn’t get enough attention, though, is operating leverage, which captures the relationship between a company’s fixed and variable costs. By breaking down the equation, you can see that DOL is expressed by the relationship between quantity, price and variable cost per unit to fixed costs. If operating income is sensitive to changes in the pricing structure and sales, the firm is expected to generate a high DOL and vice versa. If the composition of a company’s cost structure is mostly fixed costs (FC) relative to variable costs (VC), the business model of the company is implied to possess a higher degree of operating leverage (DOL).

So, once Microsoft sells enough copies of Office to cover its upfront costs, every dollar afterward drops to the earnings or bottom line. The DOL measures the how sensitive operating income (or EBIT) is to a change in sales revenue. Yes, industries that are reliant on expensive infrastructure or machinery tend to have high operating leverage.

Just like the 1st example we had for a company with high DOL, we can see the benefits of DOL from the margin expansion of 15.8% throughout the forecast period. Despite the significant drop-off in the number of units sold (10mm to 5mm) and the coinciding decrease in revenue, the company likely had few levers to pull to limit the damage to its margins. However, the downside case is where we can see the negative side of high DOL, as the operating margin fell from 50% to 10% due to the decrease in units sold. Now, we are ready to calculate the contribution margin, which is the $250mm in total revenue minus the $25mm in variable costs.

That interest expense decreases the company’s net income and can be considered a fixed cost. Sales growth is far and away from the biggest driver of operating leverage and growth of the company. Still, companies with costs tied up in machinery, plants, real estate, and networks can’t easily move on a dime and cut expenses. Operating leverage can inform investors about the company’s volatility they are analyzing. For example, companies with high operating leverage can be great and profitable and vulnerable to big changes in business cycles.